Biochar is considered one of the most promising and uniquely valuable carbon assets. Unlike biocoal, which primarily relies on carbon substitution for emission reduction, the core value of biochar lies in its ability to achieve carbon removal or negative emissions. This is becoming increasingly valuable in the international community’s pursuit of “net-zero emissions.”

Unlike bio-coal, which primarily relies on carbon substitution for emission reduction, the core value of biochar lies in its ability to achieve carbon removal or negative emissions. This is becoming increasingly valuable in the international community’s pursuit of “net-zero emissions.”

The carbon assets generated by a qualified biochar project are the portion of carbon that is stably sequestered. The process is as follows:

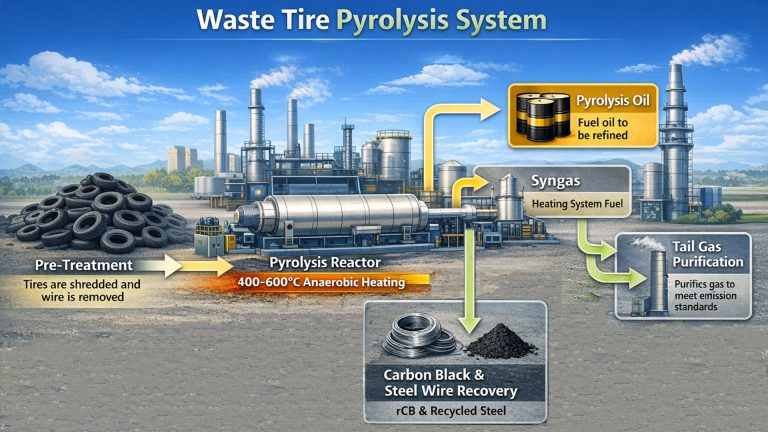

- Project Activities: Collecting agricultural and forestry waste and converting it into biochar through biomass carbonization equipment.

- Carbon Sequestration: Using the produced biochar for soil improvement. The carbon in this portion of biochar is considered to be long-term sequestered.

- Quantifying Emission Reductions: Calculating the sequestered carbon amount according to methodology. The calculation formula is typically:

Carbon Credits=Biochar Production*Biochar Carbon Content*Sequestration Ratio. The energy consumption and emissions from the biochar project operation itself are also considered for deduction. - Certification and Issuance: After verification by a third-party institution, this sequestered carbon amount can be registered as carbon credits (VCS, Puro.earth), becoming tradable carbon assets.

In the international carbon market, carbon credits are an important form of carbon asset, representing a certain amount of greenhouse gas emission reductions. The emergence of biochar projects has quantified and marketized the carbon sequestration value of biochar, injecting new vitality into the biochar industry.

Biomass pyrolysis projects achieve long-term carbon sequestration by converting agricultural and forestry waste into biochar and applying it to the soil. This also brings synergistic benefits, such as soil improvement and increased crop yields. These additional environmental and economic benefits further enhance the competitiveness of biochar projects in the carbon market, attracting more attention from investors and businesses.

How can Biochar Become Carbon Asset?

The core mechanism of biochar carbon assets is the transition from “carbon neutrality” to “carbon negativity”.

Carbon Neutral Cycle of Biomass: Plants absorb CO₂ from the atmosphere through photosynthesis during their growth, fixing it into organic matter. When this biomass decomposes naturally or burns, CO₂ is released back into the atmosphere, completing a carbon cycle. Theoretically, this process does not result in a net increase in atmospheric carbon concentration.

Carbon Negative Breakthrough of Biochar: Biomass pyrolysis plants convert biomass into stable biochar through pyrolysis. During biomass pyrolysis, unstable organic carbon is converted into chemically stable carbon-rich substances.

Biochar decomposes extremely slowly in the natural environment, with a half-life that can reach hundreds or even thousands of years. When biochar is applied to the soil, it achieves long-term carbon removal. This process is carbon-negative.

Unique Advantages of Biochar Carbon Assets

- Negative Emission: Unlike renewable energy sources that avoid emissions, biochar actively removes CO₂ from the atmosphere.

- Synergistic Benefits: In addition to carbon sequestration, biochar improves soil, conserves water and fertilizer, and increases crop yields. It brings both environmental and economic benefits.

- Waste Treatment: It transforms agricultural and forestry waste into valuable resources, reducing pollution from open burning.

In Summary

Biochar possesses enormous carbon sequestration potential, which is key to its close link with carbon assets. From a carbon sequestration perspective, when biomass is converted into biochar, a significant portion of the carbon becomes highly stable, and difficult for microorganisms to decompose.

Related research indicates that the carbon in biochar can be stored in soil for hundreds or even thousands of years, making it an effective carbon sequestration method.

From an economic value perspective, biochar’s carbon sequestration capacity enables the generation of carbon credits. These carbon credits can be sold on the carbon trading market, bringing substantial economic benefits to businesses and project developers.

As global emphasis on carbon emission reduction continues to increase, the size and activity of the carbon trading market are growing, and the market value of biochar carbon credits is also gradually rising. Currently, the average transaction price for biochar carbon credits is as high as US$160 per ton, and its economic value cannot be underestimated.

For investors and project developers, developing biochar carbon asset projects involves high technical barriers and certification costs. However, carbon credits generated by biochar, due to their negative emission attributes, may have higher value and demand in the future carbon market.