The waste plastic pyrolysis industry in Southeast Asia is at a crucial stage of transition from technological exploration to large-scale application. Its development is not only limited by the urgency of regional plastic pollution control, but also benefits from the promotion of international cooperation and innovation in pyrolysis technology.

Waste Plastic Pyrolysis Market in Southeast Asia

The market size of waste plastic pyrolysis in Southeast Asia was approximately 120 million US dollars in 2024 and is expected to exceed 800 million US dollars by 2030, with a compound annual growth rate of 35%. Southeast Asia generates over 60 million tons of plastic waste every year, with Indonesia accounting for nearly 40%. At present, the amount of plastic pyrolysis treatment is less than 1% of the total.

The waste plastic pyrolysis market in Southeast Asia is mainly concentrated in countries, such as Thailand, Malaysia and Singapore. Mingjie pyrolysis plants have been exported to the Southeast Asia. They are mainly used in the tire/plastic waste pyrolysis projects in Philippines and Thailand.

Plastic Pyrolysis Industry in Thailand

Thailand will gradually restrict the import of plastic waste starting from 2023. A complete ban will be imposed in 2025, forcing enterprises to turn to domestic plastic processing technologies. The government has stipulated through the “Circular Economy Action Plan” that the plastic recycling rate should reach 100% by 2030. It has established a $150 million circular economy fund, giving priority to supporting projects that produce aviation fuel (SAF) from plastic pyrolysis oil.

The government also supports small and medium-sized enterprises to participate in the research and development of pyrolysis technology through the Bio-Circular Green Economy (BCG) Fund. For example, enterprises that adopt continuous pyrolysis plant will be given a subsidy of 15% for equipment investment.

Thailand plans to implement a carbon tax in 2025 and allow enterprises to use carbon credits to offset 15% of greenhouse gas emissions. The waste plastic pyrolysis project can obtain additional income through carbon trading.

Plastic Pyrolysis Industry in Vietnam

Vietnam aims to reduce Marine plastic waste by 50% by 2025 and by 75% by 2030. It is planned to ban domestic production and import of plastic bags by 2026 and almost all disposable plastic products by 2031. The government requires enterprises to assume the responsibility for plastic recycling. Those who fail to meet the standards will be fined up to 305,000 US dollars.

The European Union provided 30 million euros in funding to Vietnam through the “Asia Clean Technology Fund”. It is used to support the local production of continuous waste plastic pyrolysis equipment.

Vietnam plans to introduce a carbon credit trading system in 2026. Pyrolysis oil production projects can apply for carbon credit quotas to reduce the carbon emission costs of enterprises.

Waste Plastic Pyrolysis Industry in Malaysia

The Malaysian government provides subsidies of 100 to 120 US dollars per ton of waste to pyrolysis plants and promotes the construction of standardized pyrolysis plants. The annual processing capacity target of a single plant reaches 10,000 tons.

Malaysia and Thailand have jointly promoted the formulation of the “Quality Standard for Pyrolysis Carbon Black in Southeast Asia”, unifying indicators, such as ash content (≤10%) and calorific value (≥30MJ/kg). It was officially released in 2025 to eliminate trade barriers.

Waste Pyrolysis Industry in Singapore

The National Environment Agency of Singapore is collaborating with a German company to invest in the development of a chemical recycling facility capable of processing plastics annually. Convert waste plastics into fuel oil for use in the domestic petrochemical industry.

Plastic Pyrolysis Industry in Indonesia

The Indonesian National Standardization Body (BSN) is formulating quality standards for waste plastic pyrolysis carbon black (rCB) and promoting mutual recognition with the EU ISCC + certification to enhance the international competitiveness of its products.

Plastic Pyrolysis Industry in Philippines

The Philippines requires enterprises to reduce their plastic packaging footprint by 80%. Enterprises can fulfill their obligations by outsourcing to “Producer Responsibility organizations”, which are responsible for the collection and pyrolysis treatment of waste plastic.

Pyrolysis Plant Application

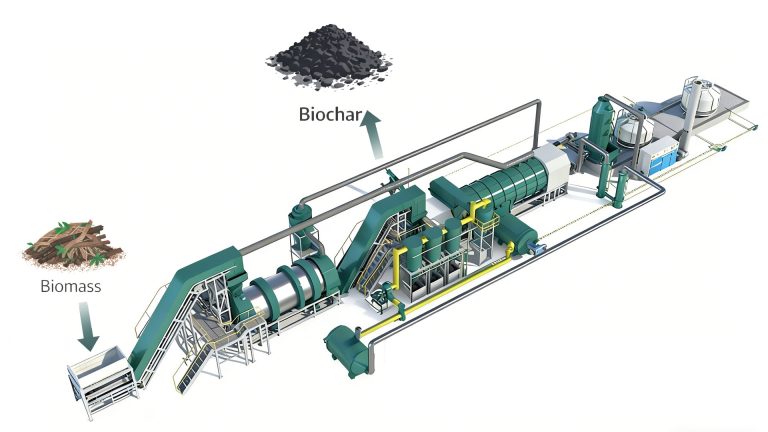

Mingjie plastic pyrolysis plant uses advanced pyrolysis technology, strong processing capacity, can greatly improve production efficiency. It converts waste plastics into pyrolysis oil (60%), carbon black (25%) and gas (15%).

The continuous pyrolysis plant is equipped with an advanced emission purification system to reduce pollution to the environment. At the same time, the waste heat in the waste plastic pyrolysis process can be recycled to reduce energy consumption.

Skid-mounted small pyrolysis equipment is specially designed for small and medium-sized enterprises. Its investment payback period has been shortened to two years.

Mingjie Pyrolysis Plants convert solid waste into energy, providing customers with effective waste pyrolysis solutions. This can not only reduce environmental pollution during waste disposal, but also maximize resource utilization. Mingjie pyrolysis plant is an ideal choice for realizing resource utilization of organic waste. It is widely used in plastic, tyre, medical waste and oil sludge recycling projects.