Plastic pyrolysis plants have become key equipment for Europe in dealing with 29 million tons of plastic waste annually. They are particularly well-suited for processing contaminated and film plastics that are difficult to recycle mechanically.

Plastic pyrolysis plants in Europe have an annual capacity of 150,000 tons of plastic-derived pyrolysis oil. Another 300,000-ton-per-year pyrolysis plant is under construction or commissioning. This accounts for 12% of global pyrolysis capacity.

Western Europe: Germany (18 plastic pyrolysis plants) and the Netherlands (12 pyrolysis plants) are in the leading positions.

Southern Europe: Italy’s BlueAlp plant (20,000 tons per year) is a model of mechanochemical recycling synergy. It achieves a waste utilization rate of over 90%.

Eastern Europe: Poland and Hungary are emerging centers for independent plants geared towards export markets.

European Plastic Chemical Recycling Projects

With the continuous adjustments to European chemical recycling policies and the market environment, different companies have shown a clear divergence in their strategic layouts.

Austrian petrochemical giant OMV recently announced a postponement of its industrial expansion plan for the ReOil chemical recycling plant. Meanwhile, UK-based Endolys plans to build a pyrolysis plant in Darlington, England, capable of processing 120,000 tons of plastic waste annually. This demonstrates the fluctuating fortunes of the European chemical recycling industry amidst policy uncertainty.

Plastic Pyrolysis Plants Turn Waste into Treasure

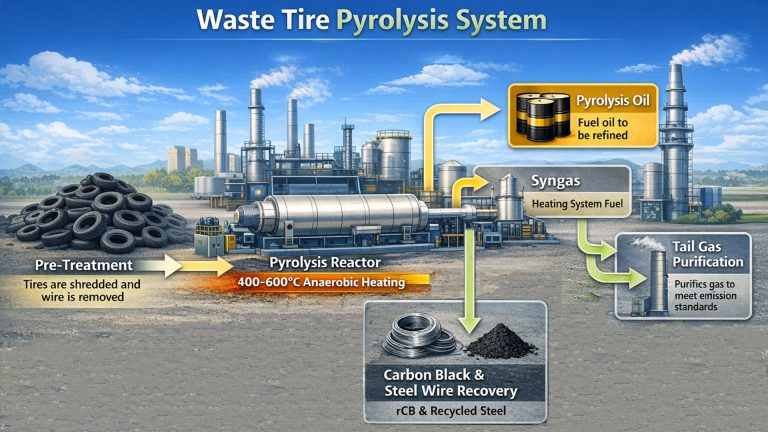

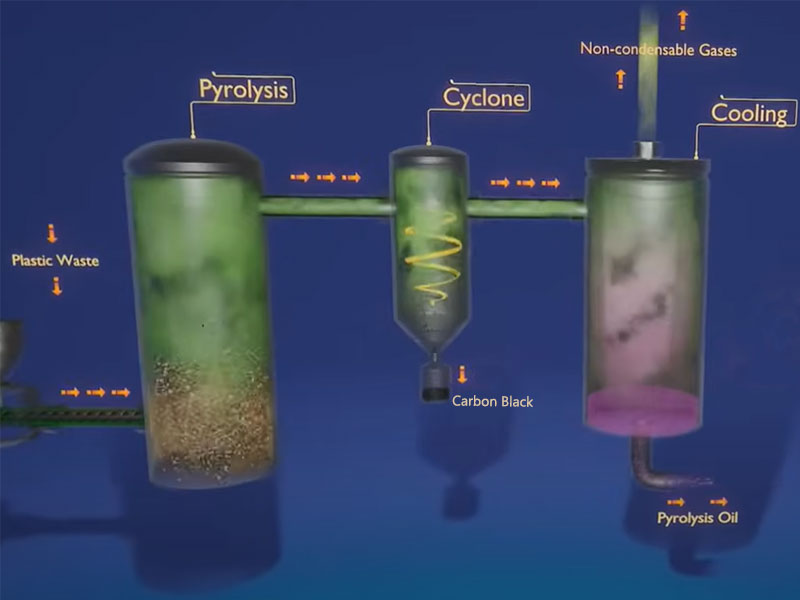

Plastic pyrolysis plants are becoming a key turning point for Europe in solving its plastic pollution problem and achieving resource independence. Pyrolysis equipment, operating in a high-temperature, oxygen-free environment, transforms difficult-to-recycle plastic waste into valuable resources: pyrolysis oil, syngas, and carbon black.

Europe’s enthusiasm for plastic pyrolysis technology is not unfounded. Behind it lies a powerful policy, economic, and environmental logic.

Policy Pressure: The EU’s Green Deal and Circular Economy Action Plan set ambitious goals: by 2030, all plastic packaging must be reusable or recyclable. Simultaneously, increasingly stringent landfill bans and high landfill taxes make simply burying waste costly and unsustainable. Pyrolysis technology, as a form of “chemical recycling,” provides a viable technological path to achieving these goals.

Breaking the Recycling Dilemma: Traditional mechanical recycling has limited capacity when dealing with contaminated, multi-layered mixed plastics. These “lower-grade” plastics typically end up only being downgraded for recycling or incinerated. Pyrolysis technology excels at processing these difficult-to-recycle plastic wastes, filling a significant gap in recycling infrastructure.

Core of the Circular Economy: The essence of pyrolysis is “molecular recycling.” It breaks down complex plastic polymers into basic molecular building blocks. These molecules can be reused to manufacture new plastics of comparable quality to virgin materials. This truly achieves a closed-loop cycle “from bottle to bottle” or “from packaging to packaging,” reducing dependence on fossil fuels.

Energy and resource security: The cracked oil produced by pyrolysis can serve as a secondary feedstock to replace crude oil, enhancing the resilience of the domestic supply chain.

Challenges Faced by Plastic Pyrolysis

Cost remains the biggest obstacle for plastic pyrolysis plants. The production cost of pyrolyzed plastics in Europe is twice that of virgin plastics. The CBAM carbon border tax adds an extra €50-80 per ton, while raw material standards are 30% stricter than in Asia, further driving up costs.

On the policy front, if the EU clarifies quantitative targets for chemical recycling in various sectors, it will unleash definite demand.

On the technological front, combining pyrolysis with hydrogen production can further reduce carbon emissions by 30%, aligning with the Net Zero Industries Act.

Conclusion

European plastics pyrolysis plants stand at a crossroads between technological feasibility and commercial sustainability. The implementation of the Quality Balance Rule has broken down long-standing accounting barriers, but fuel exemption clauses and legislative ambiguity have created new uncertainties.