In 2025, the global recycled carbon black market size from tire recycling reached US$91 million. This figure not only marks a significant achievement for the tire pyrolysis industry in solid waste treatment and resource recycling, but also foreshadows its vast development potential.

In 2025, in terms of regional distribution, the Asia-Pacific region accounted for 45.3% of the global rCB market share. Europe followed closely behind, accounting for 28%, driven by strict environmental regulations. North America accounted for 20%, thanks to advanced pyrolysis deployments and industrial collaborations. The South American and African markets combined accounted for 7%, with significant growth potential in the future.

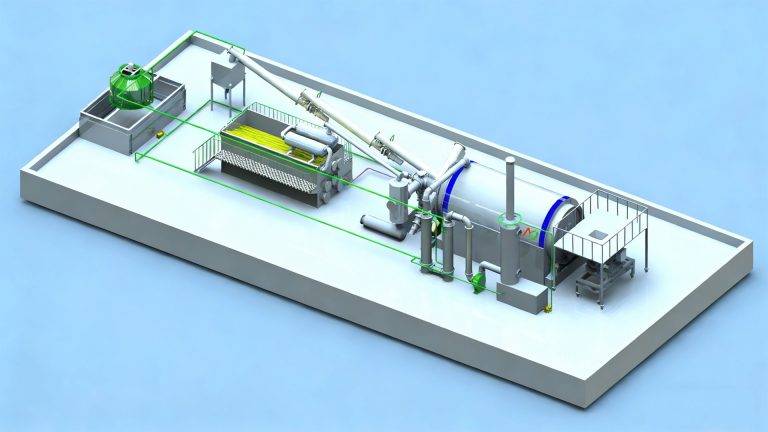

Tyre pyrolysis equipment serves as the core tool in the production of pyrolytic carbon black. In terms of pyrolysis equipment type, semi-continuous pyrolysis system remains the mainstream type in 2025. This is mainly due to their relatively mature technology, lower investment costs, and suitability for the production needs of small and medium-sized enterprises.

However, with continuous technological advancements, fully continuous tyre pyrolysis plants are gradually increasing their market share due to their high efficiency and stable production advantages. Fully continuous pyrolysis equipment can achieve 24-hour uninterrupted production, significantly improving production efficiency and ensuring more stable product quality. It is expected to become the mainstream equipment type in the future.

2026 Carbon Black Market Forecast

In 2026, the global tyre pyrolysis carbon black market will experience rapid growth, with differentiated development characteristics across various segments. High-end and specialized products will become key growth drivers.

In terms of global market size, the global market for recycled carbon black (rCB) products is expected to reach US$128 million in 2026, a 40.7% increase compared to 2025.

Regarding production volume, global recycled carbon black production is projected to reach 1.2 million tons in 2026, a 38% increase from 2025, driven by improved equipment efficiency and capacity expansion.

In terms of pricing, the price of standard-grade recycled carbon black will remain stable, expected to stay between US$100-120 per ton. This is 20%-30% lower than traditional oil furnace carbon black, maintaining a cost advantage. The price of specialty-grade recycled carbon black will remain between US$150-180 per ton, a premium of over 50% compared to standard-grade, with continued demand growth.

Driving Factors of Tyre Pyrolysis Carbon Black Market

Environmental Regulations and the Dual Carbon Strategy

In 2026, global environmental regulations will enter a period of intensive implementation, and the dual carbon strategy will be further advanced. This will become the core driving force behind the explosive growth of the pyrolysis carbon black market.

As a leader in global environmental regulations, the European Union’s “Waste Tire Management Directive” will be officially implemented, requiring member states to increase their waste tire recycling rate to 85% by 2026. The proportion of pyrolysis treatment must not be less than 20%, an increase of 2 percentage points compared to 2025. In addition, the European Green Deal explicitly supports the resource utilization of waste tires, providing environmental subsidies to pyrolysis carbon black manufacturers to promote high-end industry development.

In North America, the United States plans to invest $1 billion in subsidies for waste tire resource utilization projects. Key states such as California and Texas will expand the scope of pyrolysis carbon black subsidies, increasing the subsidy standard to $25 per ton. Canada will introduce tax exemption policies for the import of pyrolysis equipment to attract advanced global equipment. At the same time, it will promote the inclusion of pyrolysis carbon black in carbon reduction projects, allowing companies to obtain additional revenue through carbon trading.

In South America, Brazil’s standards for carbon black used in iron ore pellets will be fully implemented, driving the upgrading of local pyrolysis carbon black equipment. Argentina, Chile, and other countries will introduce waste tire recycling regulations to gradually standardize the market.

In the Middle East, the concentrated launch of refining capacity in 2026 will drive the growth of demand for pyrolysis carbon black.

The tariff policy changes brought about by the full implementation of the African Continental Free Trade Area in 2025 will also facilitate the circulation of pyrolysis carbon black products.

Tyre Pyrolysis Process Upgrades

By 2026, continuous pyrolysis technology will become the global mainstream for tyre pyrolysis carbon black production. The proportion of fully continuous tyre pyrolysis equipment globally is expected to increase to 52%. The daily processing capacity of a single unit will generally increase to 40-60 tons.

Meanwhile, big data and artificial intelligence technologies will be applied to production optimization. By analyzing production data, energy consumption will be reduced by 5%-8%, and equipment failure rates will decrease by more than 20%.

Carbon Black Demand Expansion

In 2026, global demand for pyrolysis carbon black is expected to experience explosive growth, driving a rapid increase in the global tire pyrolysis carbon black market size.

Thanks to its cost advantages and low-carbon properties, pyrolytic carbon black will accelerate the replacement of traditional oil furnace carbon black. The tire industry remains the core demand sector, accounting for 78% of global pyrolytic carbon black demand.

In 2026, global tire production is expected to reach 2.1 billion units, with new energy vehicle tire production reaching 350 million units, leading to a surge in demand for low-carbon carbon black. European and North American tire giants will expand their procurement of pyrolysis carbon black, with the procurement ratio expected to increase to over 15% in 2026.